EU won't hit its own 2030 chips production targets, auditors say

The EU is on course to grab only 11.7% of the global semiconductor market by 2030.

The EU is unlikely to get anywhere near its goal of snagging a 20% share of global semiconductor production by 2030, the European Court of Auditors (ECA) said on Monday.

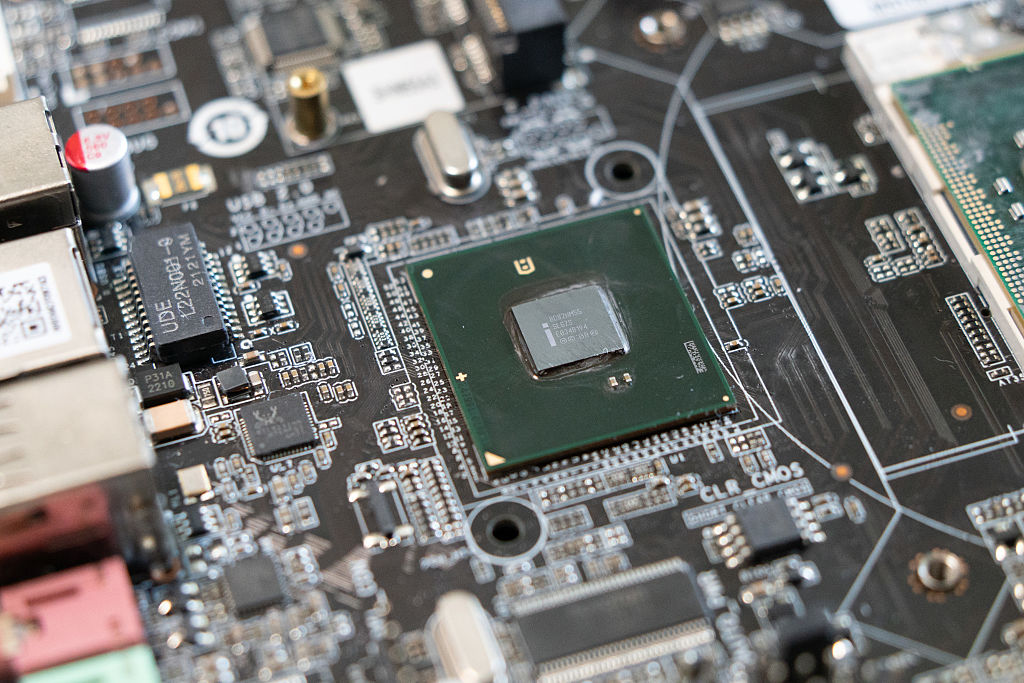

In a report on the European Commission’s targets for the chips industry, which is critical for everything from connected cars to washing machines and AI systems, the ECA points to spiralling energy costs, lengthy planning procedures and a shortage of raw materials as key factors throttling growth on the continent.

The EU’s target to cover a fifth of global chip production by 2030 is “disconnected from reality,” the ECA’s Annemie Turtelboom, a former Belgian minister, said when presenting a report on the Commission’s strategy.

In the wake of the COVID-19 pandemic, which exposed vulnerabilities in global supply chains, the EU launched an ambitious plan to reduce its dependence on chip manufacturers based mainly in South East Asia and the United States.

The EU Chips Act was targeted at relaxing subsidy rules to encourage firms to set up projects in Europe, but the auditors fear that, despite being in place for 18 months, the rules aren’t delivering the necessary boost.

Citing the Commission’s own analysis, the report says the EU is projected to reach only 11.7% by that date, still an improvement from its 7% share in 2020 but nowhere near the stated aim.

What’s holding the EU back?

According to the EU auditor body, several factors are holding the EU back.

Semiconductors are at the centre of geopolitical tensions and are the target of both tariffs and export bans. In addition, Europe’s high energy prices and lack of raw material supplies – for example, China controls 95% of the world’s refined gallium – reduce the allure for chip-makers to set up on the continent.

Another problem is linked to the size of the producers. Because the companies involved in EU projects are very large, any delay or cancellation to a single factory programme – such as Intel’s €34.2 billion mega-projects in either Germany or Poland – significantly undermine the bloc’s chances of hitting its 20% target.

The auditors also said that the EU’s Chips Act focuses on meeting current industry needs, rather than planning for future industry trends. Those are expected to focus on chips enabling artificial intelligence or units with smaller engraved circuits, which are more efficient.

In addition, the Commission only controls 5% of the funds announced under the law meaning it has only a certain amount of control over where cash is allocated.

The Commission also has “a data problem” as EU countries do not have any obligation to formally inform the Commission of their industrial projects, Turtelboom added.

To mitigate these issues, the EU watchdog is recommending that EU lawmakers urgently review the 20% target and introduce systematic monitoring of factory construction plans.

It also recommends that the EU starts preparing the next semiconductor strategy, which the Commission has already announced will happen in the form of a “Chips Act 2.0”.

Since 2023, the Chips Act has prompted more than €80 billion in investments, the Commission said in a reaction to the Court’s report. The €80 billion excludes the €34.2 billion investment already frozen by Intel.

(de, jp)